One needs money and personal finance tips for all purpose, it’s importance can’t be undermined. Whether any area or field- money is essential. So, is it’s savings and usage.

Personal finance is art and science of managing money by discipline, knowledge, and smart decision-making. By saving consistently, avoiding debt traps, investing early -anyone can build a healthy financial foundation. The final goal is to achieve financial independence—where money becomes an eye – opener for creating opportunities, and living life on one’s own terms. Having these personal finance tips in mind not only strengthens financial security but also brings long-lasting peace of mind. There are below – mentioned personal finance tips are there to make best use of money.

Personal Finance tips – a vision board

Your money habits determine a lot about your future. So, track your financial goals on a financial board. Whether there is wedding that is coming or you have to support your child education – all goals need a careful planning and a greater vision board in every sense of the word.

Financial goals and personal finance tips alongside

Do savings and determine how much and by what date? You need to get out of debt and by when? So, what are the tasks that you accomplish with money that can take you ahead.

Loving yourself

People who have paid debt love and value themselves more. So, take care of yourself like anything and everything. Loving yourself is the first that you can take in every sense of the word.

Smaller and short- term goals

The bigger the goal is, farther it seems. For example: building a home. Small goals feel near and give quick responses. It will break apart the goals and gives you more time for planning.

Get rid of negativity

Get rid of negativity and adopt positive mantras and vibes. If you started with this – I won’t be out of debt ever. Then, game is done and over. So, be positive along the way. Personal finance tips matter a lot.

Get your body and finances in shape

Once you are taking care of body by exercises or taking up running – it leads to higher pay. As it gives you much confidence as habits and discipline get it going. This reminds that you are taking steps for your future.

How to savour

Learn how to savour means appreciation of what you have right now instead of acquiring more and more things. This will make you learn about gratitude.

Money buddy helps a lot

Making friends whose priority is to be wise with money will let you learn some basic traits. It will bring in some accountability and responsibility.

Making a financial calendar

As you go about the business of making money like a pro, you can’t trust yourself so mark the calendar with reminders to pay taxes or pull out a credit report.

Interest rate

Which credit card you must pay? The one with most compound rates. Which debt you must pay first? The one with more interest rate. Which savings you must do?

With best interest rate. For good money habits, check interest rates beforehand..

Your net worth

Assets minus debt is the bigger picture that you should apprised yourself so that you come to know about the progress you are making. Your net worth let’s you know about the current financial situation. These personal finance tips take you a long way.

Set a budget

How much is the income? How much are expenses. This is the starting point of all financial goals. When you do long-term planning, you need to think about all of this to be precise.

Daily minute

Take a money minute as to check financial transactions. Also, keep a track of problems and it’s progress by taking a minute.

20% for financial priorities

Be discipline, make good habits by simply paying off debt, creating emergency fund or keeping money fore retirement. This is the best you can do with money.

30% for lifestyle spending

Other than basic necessities, thirty percent can be used for dinners, restaurant, movies etc. There are many expenses which are covered under lifestyle spending.

Spend on experience

Make purchases of concert or picnic in the park in spite of pricey possessions. Research says spending on experience gives much satisfaction and happiness.

Shop solo and find alternatives

Instead of going to mall with someone, socialize a walk in the park. Instead of incurring expenses on impulse purchases, save money for future or any uncertainty that may occur.

Start saving now

Whether it’s retirement or any other financial goal- you must start saving. Not next year but now and today. It is most ultimate thing you can do for your future.

Don’t cash out your retirement account

You will get a penalty plus it will hurt your savings many times over. There will be a tax bill too. So, don’t cash out your retirement savings. These are the most important personal finance tips.

Plan more

Do planning as plan is a trap to capture future. Do everything in planning whether you are taking a loan or saving. Treat everything with attention. This is important as per personal finance tips.

Raise retirement funds when you get a raise

Remember, earlier you said – you will save more for retirement when the time comes. So, at this time do more when you get a raise.

Be careful for your credit score.

So you want financial success in life? So, be careful about your credit score. Credit score helps build credit worthiness and let’s the person sit secured at the end of the day.

Monthly budget of savings

If you need savings at the end of the day, make a monthly habit for that. It will help you cover emergency and will account for most uncertainty.

Have your savings in different checking account

There should be a separate checking account for saving. If you keep in the same checking account, there are high chances of spending money.

Financial health

Check your financial health and goals with the help of financial advisor. When an expert enters, he will guide you on most occasions.

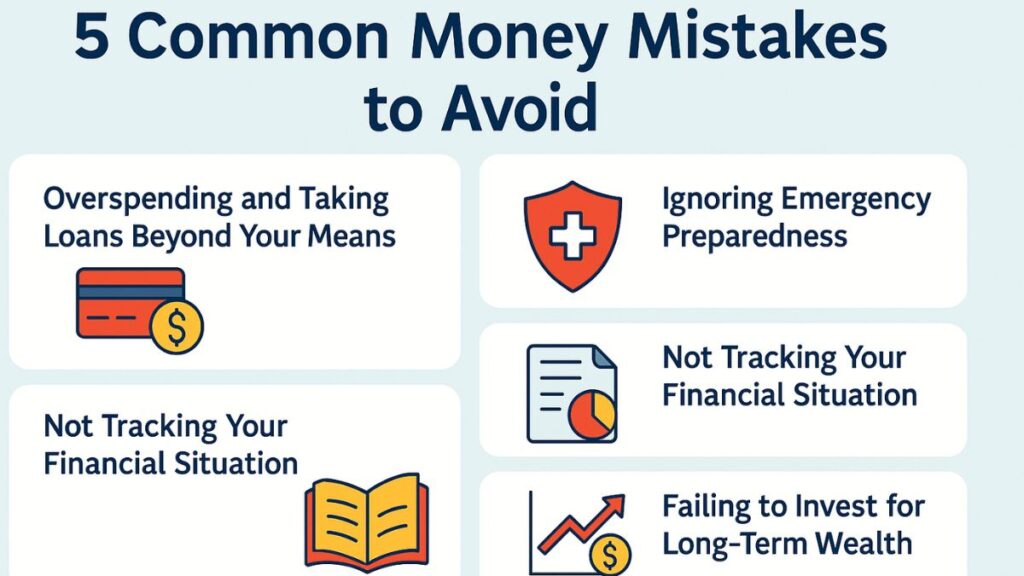

Emergency fund

If your car breaks, you have leaky roof, there is job loss- then there comes the role of emergency fund. 3 to 6 months of savings be accumulated and saved for a purpose.

Make fixed deposits

It works like magic. As it is the most secured deposit. It is a long- term investment i.e. like fetches you returns after a stipulated period.

Don’t overspend

Don’t make unnecessary and impulse purchases. They will ultimately give a wrong impression on the habit of saving money. Rather be serious about shopping and spending money.

Buy insurance

Buy insurance for difficult time or in the event of accident or natural calamity. Have personal health insurance and term insurance in place. Insurance will help you a lot in future.

To wrap up

There are many goals like financial ones – to support education, for vacation, send children abroad, you need finances for their marriage, you need for retirement planning. Do as many savings in different bank times so that you don’t encash them and spend for unnecessary things. Be wise in shopping, don’t go for unnecessary stroll in the mall. So, above tips will ensure that you run in coordination with your financial success and financial discipline.