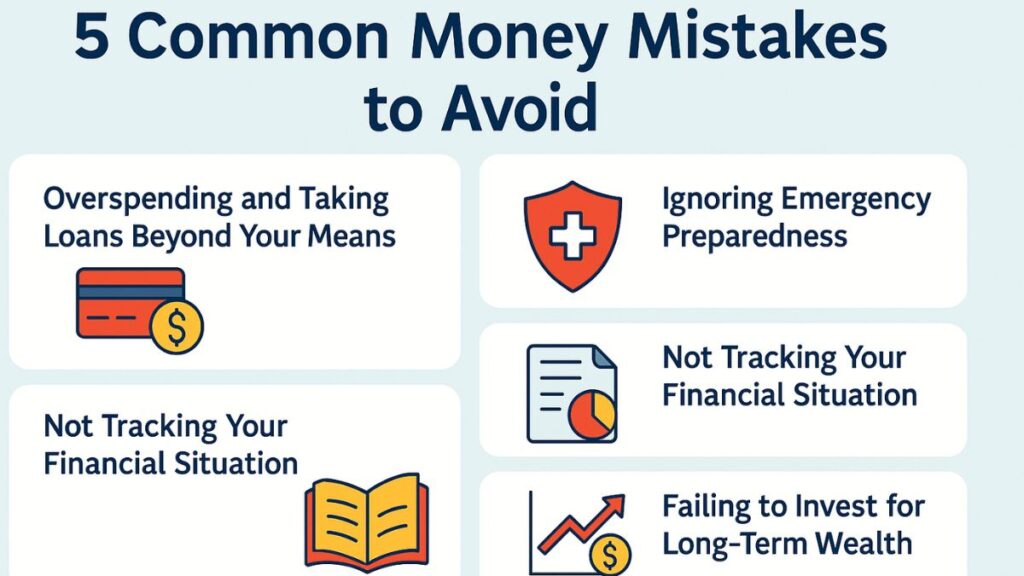

A strong financial foundation has to be laid down before 40, so, debt management, more savings, insurance coverage and long- term wealth creation has to be done.

money things to know by 40 means a milestone comprises of turning 40! So needs financial stability and discipline. Automate your savings, retirement planning, financial goals like buying a home, creating will, coming out of debt is necessary .

- Don’t let expenses outshine your income

- Before you spend, there has to be savings

- Budget must be made to track expenses

- Have knowledge of financial terms like compound interest and inflation

- Have a strategy for investments

- Plan for multiple sources of income

- Have a check on financial health

- Slowly and steadily, increase your income

- Do automatic transfer to different accounts as savings and investments

- As soon as you can pay your personal loan and credit card balances

- Maintain an emergency fund of 6 to 12 months

- Balance risk and return by investing in fixed deposits, mutual funds, stocks and bonds

- Make emergency fund incase of home or car repair

- Your portfolio should beat inflation

- House and car should be managed without a financial dig.

- Children education and major events must be covered

- Have a health and term insurance in place

- Check your nominees on bank balance and investment policy

- Set financial goals to purchase a car or home

- Have retirement corpus in place and retirement planning too

- Control your errors and make progress. Don’t sit on past mistakes

- Have financial discipline and save regularly

- Seek professional guidance and hire financial advisor

- Investment in yourself is the best thing you can do to yourself

- Take account of inflation – things which are priced now will be costly later in 5 more years. Value of money will be less. So, do savings keeping inflation in mind.

money things to know by 40 means creating discipline and savings monthly.

Money, as such, is an important factor and all pervasive in all fields of life. Finance is the backbone of every family. As the unit’s requirements are like medical emergency, urgent expenses, other requirements. So as to complete financial goals such as a big fat wedding or sending children abroad – savings become all the more necessary. Finance is an essential aspect of life. Without it, we can’t incur expenses. So we need to make budget and do monthly savings. In case of emergency, emergency fund needs to be created. Everyone needs money for sustenance. From smallest to biggest purchase, expenses must not be unnecessary.

For example – cost of son’s wedding will take 20 lakhs but to say you have to save 35 lakhs as we have to understand cost of inflation too.

One needs money for their own dreams. People need investment for their own business. For example – one needs to start a bakery or one needs to start a salon to satisfy their entrepreneurial instincts. So, one needs to have good savings amount in checking account. Also, role of insurance is too much. Incase of any mishappening, one needs to have health and term insurance in place. money things to know by 40 means a lot for your money and savings.

Other than this, there are more than one financial goals. The list is big as to whole lives we need money for their completion. For example – daughter marriage or daughter education.

It is more about freedom, stability and joy. We have had enough experience of ups and downs in life. So, we by now know it’s about planning, discipline and long- term thinking. Money is not a tool it’s discipline i.e. financial decision and discipline. It means regular monthly savings. Without this, it is difficult to complete all financial goals to be precise.

Create a budget– important factor in money things to know by 40

Now, if you got good salary then, your income should not be more than expenses. Because otherwise you have to take a side gig or have multiple sources of income. So, what you have to do is track your income and expenses and pay off high -interest debt.

High return investment.

Save in high return investment as to put money in stock, bonds, shares and Mutual fund. Follow the rule of 50:30:20 50 percent in needs and 30 percent in wants and 20 percent as savings. Try to be disciplined with your money.

The role of emergency fund

If you need a car or home repair, if you have a leaky roof – we should have six months to 1 year income saved to incur expenses.

We should be able to incur without borrowing or selling sips or investments.

We should understand the role of money early on, because it is useful in every field. Money should be spent wisely as money has become the most important thing these days. Expenses start from the time we are children till we become adults. That is why money should be used very carefully. Life begins at the age of 40. We become wise, if money is managed properly then we can easily bear all the expenses, big and small. We should be self-reliant and all the expenses have to be done very carefully. So that we can comfortably move into the future or retirement years around 50.

To wrap up

Money needs to be understood in minute details. Because it’s importance can’t be undermined. From the time of children education to all bills of wedding to any medical emergency – money is needed and is important. We need to careful and make a budget. We should do thinking and long term planning for its usage. By age 40 we need to have insurance, have emergency funds and pay off our borrowings in time. Just home loan must be there and it is a secured expense. Future must be secured and our retirement year must go easy. It is not we can manage it overnight, it is not an easy formula, it takes lot of diligent planning and all sorts of things to have financial discipline which makes sure you have good financial health.

Pingback: Google Gemini AI Couple Photography: 2026 Trends, Insights & Guide